Accident Plan Insurance

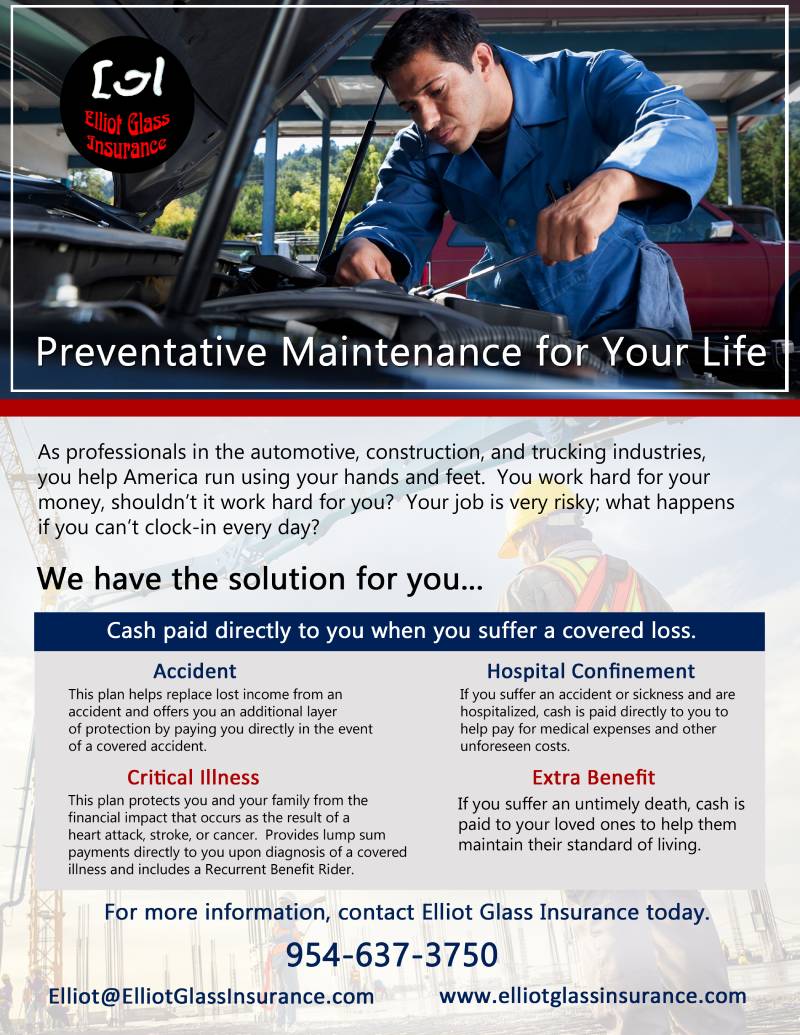

Accident insurance is a supplemental insurance plan that pays a benefit if you get hurt unexpectedly. Your accident insurance benefit allows you to defray the out-of-pocket cost of your deductible as well as non-medical costs that you may need help paying such as your mortgage, childcare, or even groceries.

Accidents are never part of the plan. Accidents happen, and when they do, you want to make sure you have insurance coverage to help you recover.

This plan helps replace lost income from ANY accident. Also offers you an additional layer of protection and pays you directly in the event of a covered accident.

The takeaway

- Accident insurance gives you a lump sum payout when a covered event occurs.

- Flexibility lets you pay for a range of expenses.

- A group policy may be available through your employer.

WHAT IS COVERED?

- Ambulance

- Hospital Admission

- Hospital Confinement

- ICU Confinement

- Burns

- Dislocations

- Fractures

- Internal Injuries

- Concussions

- Lacerations

- Eye Injuries

- Torn Rotator Cuff

- Torn Knee Cartilage

- Ruptured Discs

- Wellness

- Physical Therapy & More

Includes an annual wellness benefit for covered preventative tests.

As an added bonus, an Accidental Death policy is included which covers individuals, spouses and children from Covered Accidents and Common Carrier Accidents.

‹ Back